Economics Job Market Update: November 2025 - A Historic Low

As we reach mid-November in the 2024-2025 academic hiring cycle, the data from JOE (Job Openings for Economists) paints a concerning picture: this year is shaping up to be the worst economics job market on record since at least 2015.

This post provides an update to my earlier analysis of JOE posting trends with fresh data through November 2025. All code and data remain publicly available on GitHub.

The Overall Market: A Historic Decline

The numbers are stark. As of week 47 (mid-November), cumulative postings for the 2024-2025 cycle stand at just 760 positions - approximately:

- 37% below the 2015-2019 average

- 17% below even the pandemic-impacted 2020 cycle

- 38% below last year’s already-depressed levels

If this trajectory continues, we’re on track to finish the year with the lowest total posting count in over a decade.

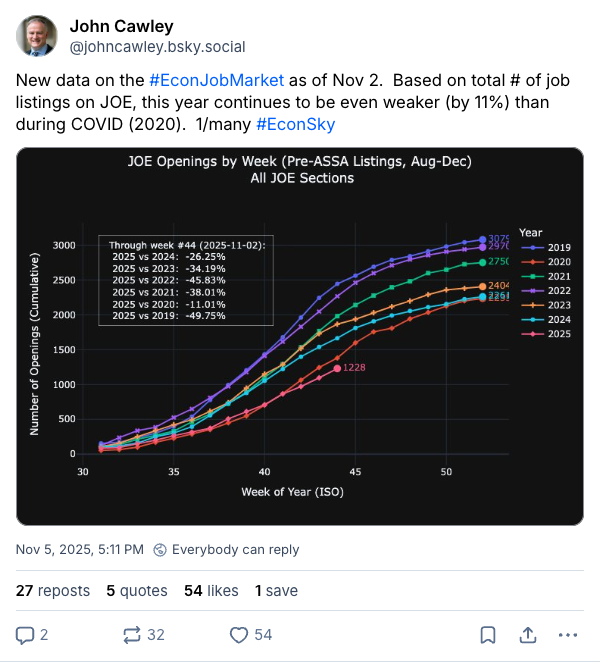

This finding is in line with a recent post by John Cawley on Bluesky:

A few comments on this: I’m not sure how Cawley has so many more posts than I do. My numbers come from just the raw counts exported on the AEA JOE website. All of the trends seem very similar, but he has far larger numbers. Maybe let me know on Bsky if you think you have an idea?

A Silver Lining: Finance Jobs Show Resilience

In contrast to the overall market’s collapse, finance positions show a more resilient pattern. While still below their 2015-2018 peak (~150 postings per year), finance jobs are tracking much closer to recent years’ levels at around 95 positions.

Perhaps most telling: finance jobs now represent 12.5% of all JOE postings in 2025, up from the typical 7-9% in recent years. This isn’t because finance hiring has surged - rather, it reflects that finance demand has held relatively steady while other fields have contracted sharply.

Finance Jobs by Year

| Year | Finance Postings | % of Total | Notes |

|---|---|---|---|

| 2015 | 153 | 9.9% | Pre-decline peak |

| 2016 | 131 | 9.1% | |

| 2017 | 138 | 9.1% | |

| 2018 | 153 | 9.8% | Peak year |

| 2019 | 137 | 9.4% | |

| 2020 | 103 | 9.1% | Pandemic impact |

| 2021 | 123 | 8.8% | |

| 2022 | 103 | 6.9% | |

| 2023 | 93 | 7.2% | |

| 2024 | 102 | 8.3% | |

| 2025 | 95 | 12.5% | Relatively stable |

The data suggests that the current market contraction is hitting non-finance fields particularly hard. But, it may be that JOE is less of a relevant source of job postings now — there may be a fragmentation of job posting locations, as well as a decentralization of private sector postings.

Data current as of November 24, 2025. All visualizations are interactive - hover, zoom, and click legend items to explore the trends yourself.